Widener Student Managed Investment Funds Surpass $1 Million Milestone

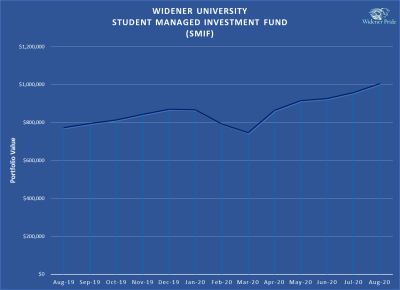

Investment portfolios managed by students and faculty advisers in Widener’s School of Business Administration have doubled in the past five years, now exceeding a combined $1 million.

The feat – achieved through a sound long-term investing strategy and despite this year’s market volatility – has helped Widener University grow a small portion of its endowment and helped undergraduate students learn to buy and sell stocks using real money.

“This is an extraordinary achievement for the many highly motivated and talented students who served and continue to serve as portfolio managers for the Student Managed Investment Funds,” said Monty Mansur, a professor who co-advised the Money Club and oversaw the funds before his retirement.

Associate Professor Tunde Odusami, who manages the Money Club, agreed.

After graduation, many of the student portfolio managers and investment analysts have gone on to establish successful careers in the financial services industry and in corporate finance roles. We have been fortunate to have the opportunity to work with them. — Tunde Odusami

For alumni like Ryan Yost ’19, who managed one of the three funds, the milestone serves as a testament to Widener’s commitment to providing real-world experiences that are needed for students to succeed in their future careers.

“At the end of the day, that is how you learn – having real responsibility,” said Yost, a research analyst at the International Monetary Fund. “Widener gave me and many other students the opportunity to apply classroom finance theory to the actual portfolios and to learn from seasoned professionals.”

The Seeds of Investment

In the 1980s, the Student Managed Investment Funds began with a $10,000 donation from John and Grace Sevier, long-time supporters of the university who are now deceased. The seed money initially enabled students in a portfolio management course to learn stock trading, and then later became the responsibility of Widener’s Money Club, which grew the fund to over $50,000.

In 2014, members of the club, along with Mansur, approached the Widener University Board of Trustees to ask if they could manage $100,000 from the university endowment. The endowment’s growth is used to increase financial aid, invest in new programs and technology, and upgrade academic buildings and student housing.

Ultimately, they didn’t get the $100,000. They presented their case so well that they received $500,000 instead.

“The trustees and donors gave all of us an opportunity that has made a world of difference in our lives,” Yost said.

Read More: A Wealth of Experience

Three portfolios were created with these funds – the large cap, mid cap, and mutual funds. Money Club portfolio managers and analysts examine stocks, develop proposals, and present buy/sell recommendations to an advisory board of professionals who provide investment guidance. The students conduct their work on Bloomberg terminals in Widener’s state-of-the-art Finance Lab.

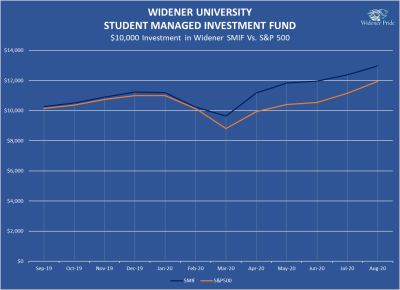

Over the last five years, the three funds have had a combined return of approximately 17 percent – well above the return on stock market benchmarks like the S&P 500.

“It’s important to note that this outstanding rate of return was achieved not by investing in risky instruments, like options and derivatives, but by taking a more conservative approach,” Mansur said.

Learning from Market Fluctuations

For students currently managing the funds, the recent stock market fluctuations prompted by the COVID-19 pandemic have been a hands-on lesson in investment strategy during a period of turmoil.

To protect from losses, the team uses stop-loss orders, which prompt the sale of a specific stock if it falls below a certain value. The market’s tumble in mid-March triggered the sale of many of the funds’ stocks.

“We then bought back nearly every stock we previously had, except some of the travel and hospitality stocks because we knew those sectors would be impacted longer,” said Money Club President Donovan Stuard ’21, who currently manages the mid-cap fund. “The stocks soon went back up.”

Stuard, majoring in finance, economics, and accounting, said weathering the market volatility could not have been replicated in a classroom or a simulation.

“I don’t think I would get that experience of managing real money anywhere else,” Stuard said. “The growth we’ve seen in a relatively short amount of time is a great feat and testament to the commitment of the professors and university.”

But, Stuard also knows the growth wouldn’t have been possible without guidance from advisory board members, as well as the alumni who laid the groundwork as student portfolio managers years earlier.

Yost said he is proud to have contributed to the ongoing success of the funds, and now uses those skills every day in his research analyst position at the International Monetary Fund. He is one of a small number of analysts who joined the program with only an undergraduate degree.

“I definitely feel comfortable at work presenting to colleagues and working in an analytical team environment,” Yost said. “And, I attribute a lot of that ability to the large-cap fund team at Widener. I’m more comfortable than I would have ever been had I not had those opportunities.”